Irs Schedule C 2024 Instructions

Irs Schedule C 2024 Instructions – Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .

Irs Schedule C 2024 Instructions

Source : www.acawise.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

The IRS Releases New 1095 Draft Instructions for 2024

Source : blog.acawise.com

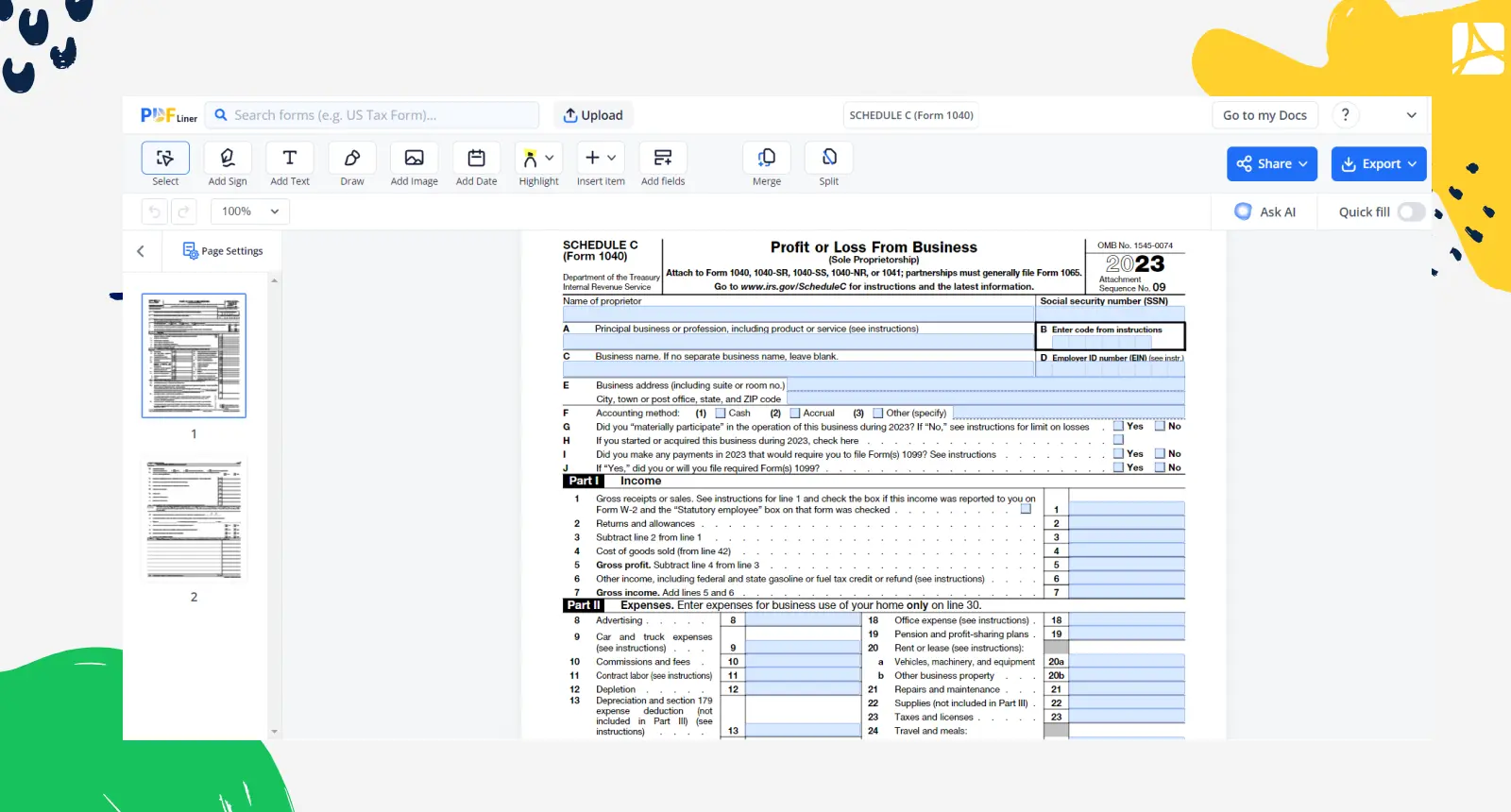

Taxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.com

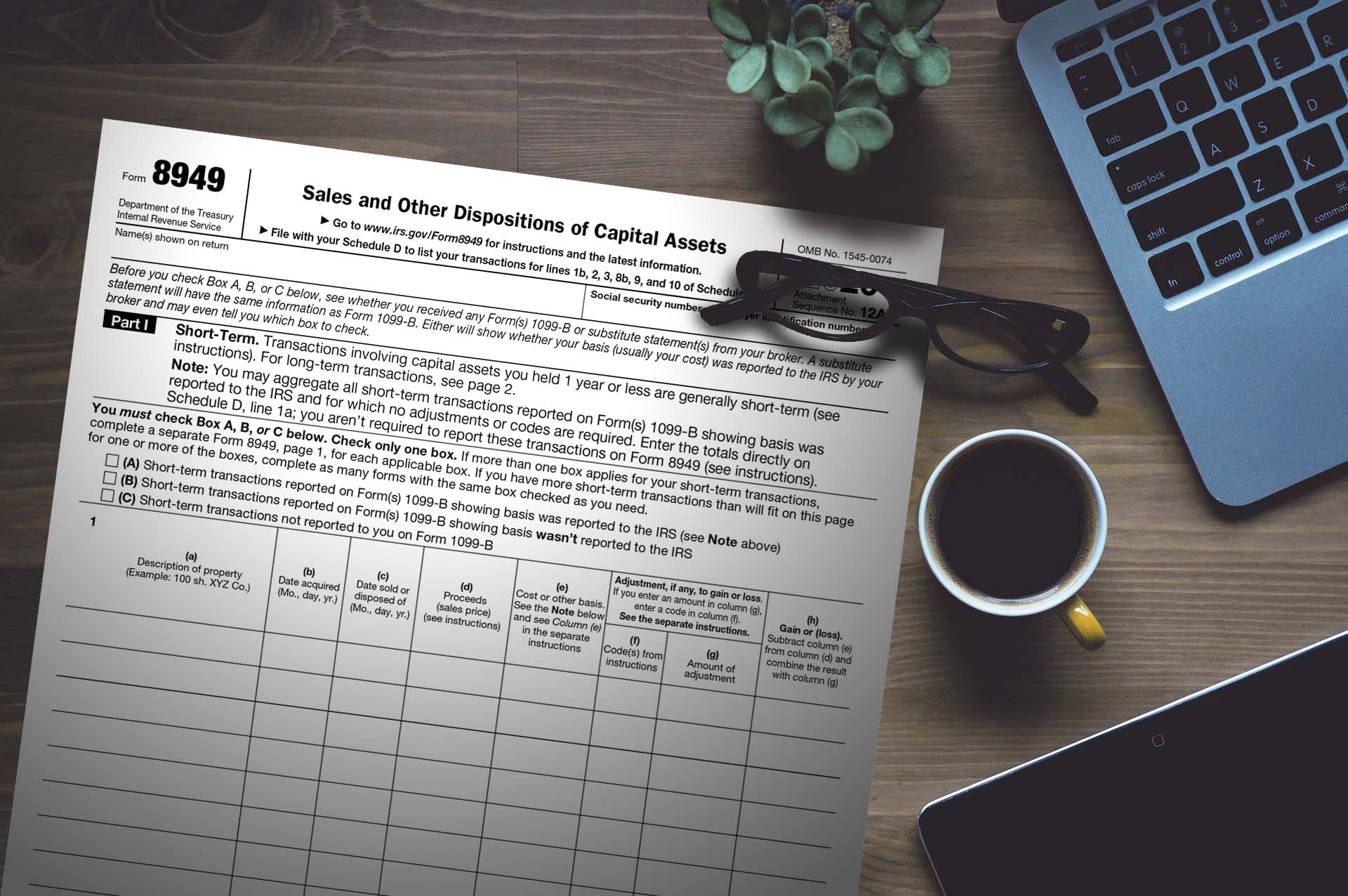

IRS FORM 8949 & SCHEDULE D TradeLog

Source : tradelog.com

Cryptocurrency tax software firm ZenLedger raises $6 million

Source : www.ledgerinsights.com

IRS Form 6765

Source : kruzeconsulting.com

IRS moves forward with free e filing system in pilot program to

Source : www.fox13memphis.com

IRS Form 5471

Source : kruzeconsulting.com

Schedule C 1040 line 31 Self employed tax MAGI instructions home

Source : individuals.healthreformquotes.com

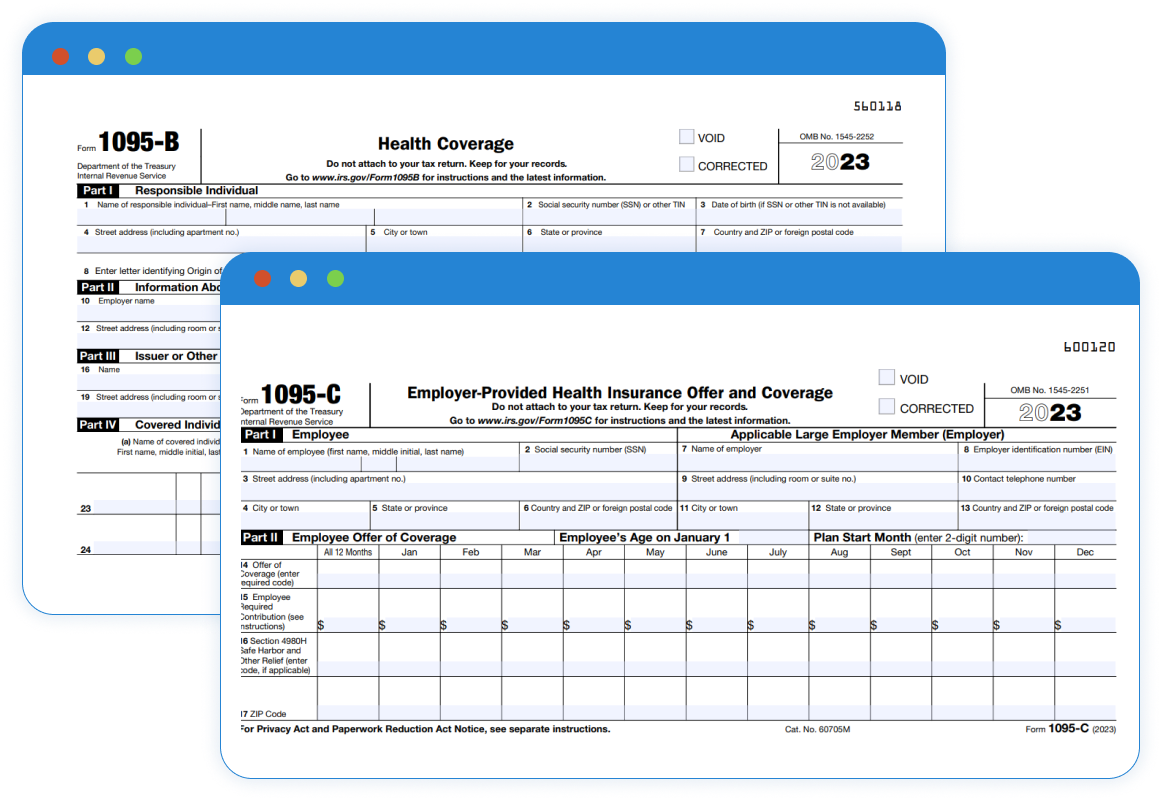

Irs Schedule C 2024 Instructions The IRS Releases Final Version of Form 1095 B & 1095 C for 2023 : The IRS has announced new income tax brackets for 2024. The IRS issued a press release describing the 2024 tax year adjustments that will apply to income tax returns filed in 2025. Standard deduction . The Internal Revenue Service announced inflation adjustments on Thursday for more than 60 tax provisions for tax year 2024. Revenue Procedure 2023-34 sets out the tax year 2024 adjustments, which .