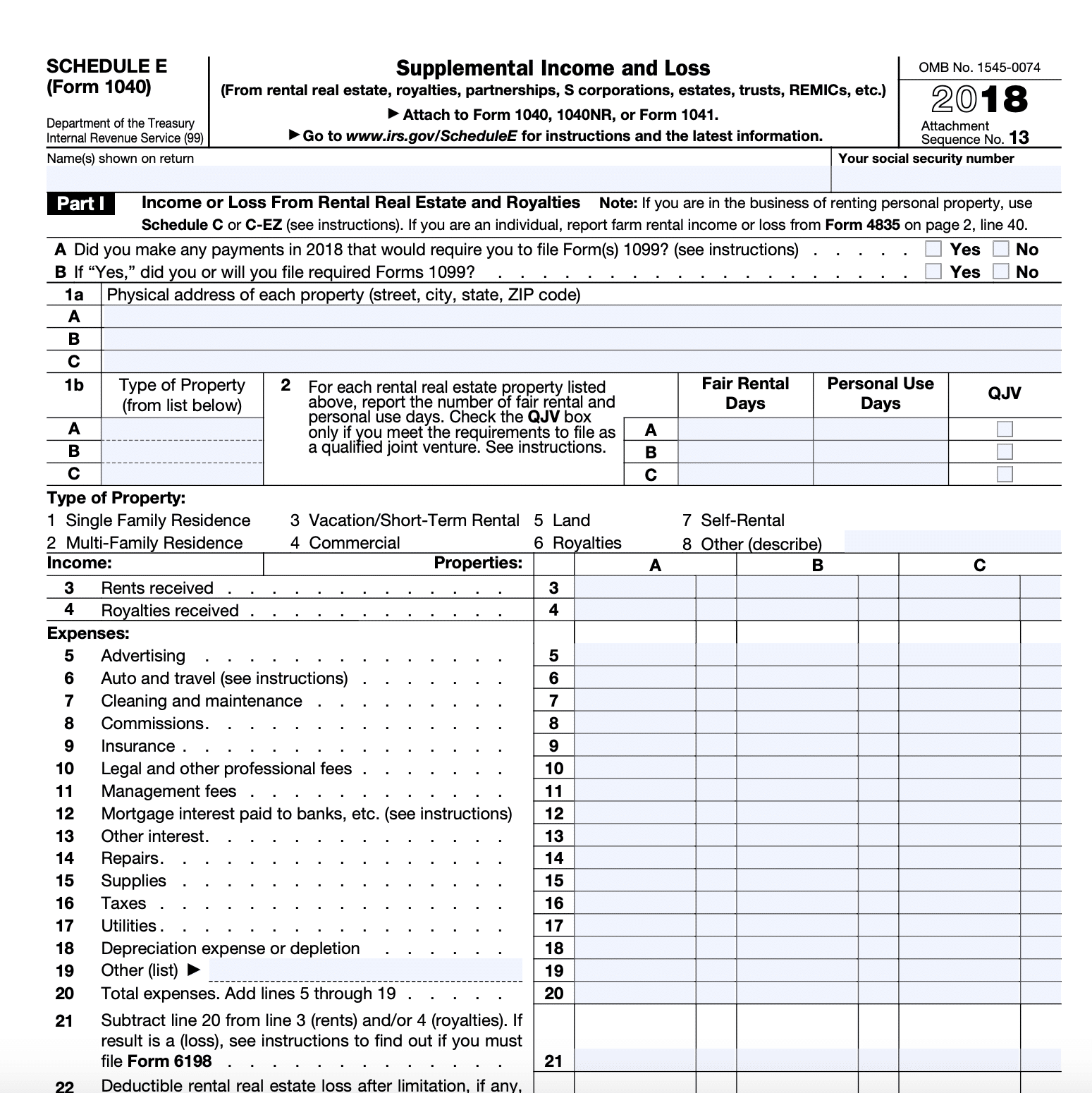

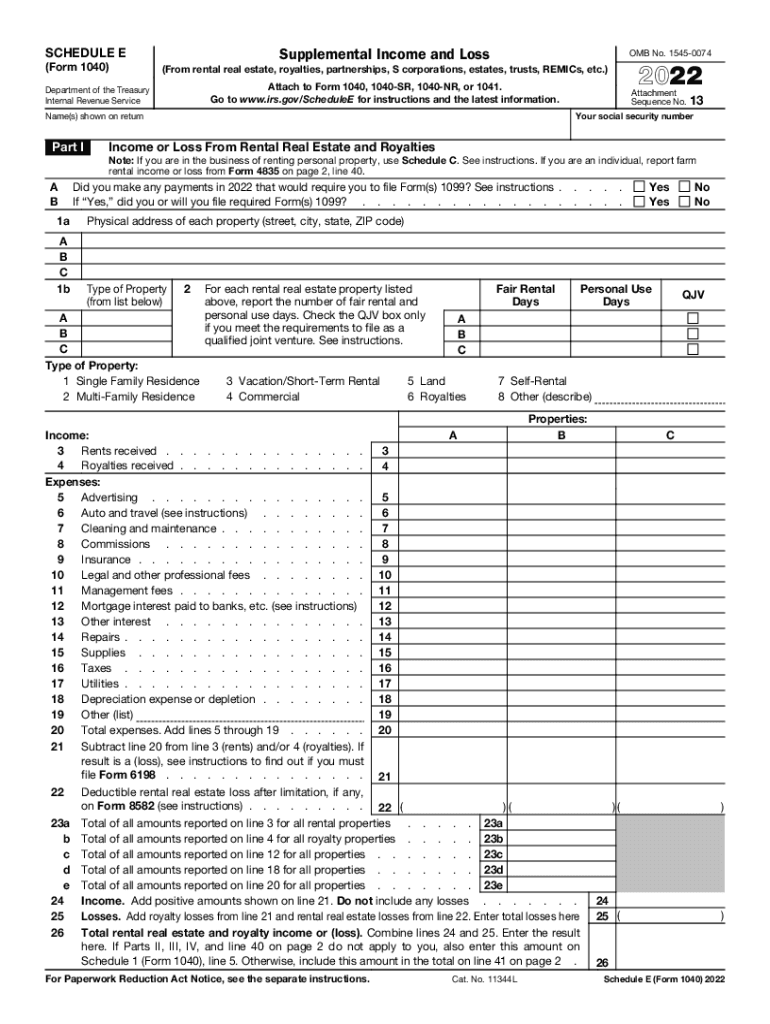

Irs Form 1040 Schedule E Instructions 2024

Irs Form 1040 Schedule E Instructions 2024 – Don’t forget about this form Tax for a flat rate of $50 in 2024, credit score tracking, personalized recommendations, timely alerts, and more. Schedule E is a supplemental tax form that is . Choose whether you are going to take the standard deduction or itemize your deductions on Schedule A Your Completed Form Finally, send your completed Form 1040 to the appropriate IRS address .

Irs Form 1040 Schedule E Instructions 2024

Source : thecollegeinvestor.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

IRS moves forward with free e filing system in pilot program to

Source : www.fox13memphis.com

Tax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.com

Illustration Of Tax Form. Business And Finance Concept Stock Photo

Source : www.123rf.com

3.11.3 Individual Income Tax Returns | Internal Revenue Service

Source : www.irs.gov

What is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

LifeCycle Tax and Wealth Management | Pensacola FL

Source : m.facebook.com

2022 Form IRS 1040 Schedule E Fill Online, Printable, Fillable

Source : irs-form-schedule-e.pdffiller.com

IRS moves forward with free e filing system in pilot program to

Source : www.sandiegouniontribune.com

Irs Form 1040 Schedule E Instructions 2024 What Is Schedule E? Here’s an Overview and Summary!: Want daily news updates? Just add your email and you’re on the list. (We will never spam you). Please enable JavaScript in your browser to complete this form. . Schedule C is a form that self-employed people have to file alongside their tax return, or Form 1040. “The difference between Form W-2 and Schedule C is that the W-2 is for wages earned at a job. .