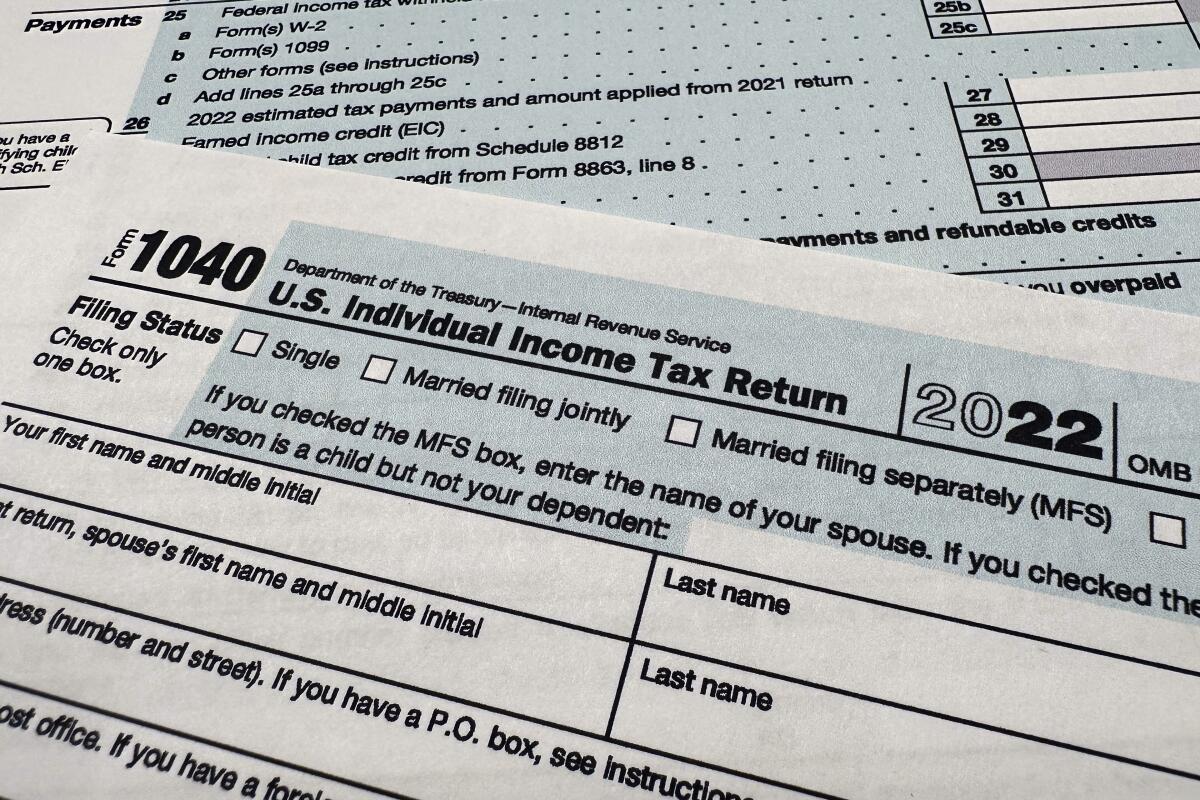

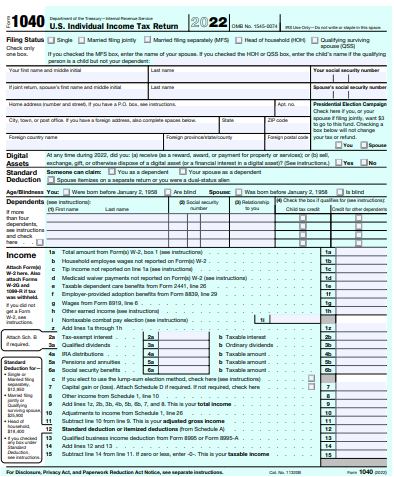

Irs 2024 Form 1040 Schedule B

Irs 2024 Form 1040 Schedule B – For 2024, the maximum HSA contribution for somebody with self-only The HSA catch-up contribution limit for people age 55 and over is not inflation adjusted, so it remains at $1,000. 0% tax rate if . The Internal Revenue Service has released its individual income brackets for 2024. Tax brackets are adjusted annually to address “bracket creep,” the name given to describe when inflation .

Irs 2024 Form 1040 Schedule B

Source : www.taxesforexpats.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

IRS moves forward with free e filing system in pilot program to

Source : www.sandiegouniontribune.com

IRS Schedule B Walkthrough (Interest and Ordinary Dividends) YouTube

Source : m.youtube.com

Maximizing Your Tax Savings: IRS Form 5695 and Residential Energy

Source : www.taxfyle.com

What is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

What is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

What Is a Schedule B IRS Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Irs 2024 Form 1040 Schedule B Schedule B (Form 1040) Guide 2023 | US Expat Tax Service: Some gifts that a small business owner gives to their employees may be taxable, while others are not. Here’s how to know the difference and understand record-keeping requirements and best practices. . Make sure you compare both methods and select the one that benefits you the most. Refer to Schedule 3 of Form 1040 for additional tax credits and complete it as applicable. 9. Calculate Taxes Owed or .